“What do you want to do with your life?”

“What do I want to do with my life?” It is the most important question to answer in any person’s life. It is “The Question.” Yet the way it is commonly asked today—“What should I do with my life?” — is disempowering, it is the wrong way to ask it. The right way is to place responsibility for the answer with yourself: “What do I want to do with my life?” with emphasis on the “I want.” The word “should” smuggles in guilt; it implies there is some higher order that we must live up to other than our own happiness. It suggests that we have an obligation to something or someone other than ourselves. Don’t we all have something we “should” do with our life? The answer is “No!” There is nothing you should do with your life and there is nothing you must do with your life. Your life is just that—your life. You are free to decide what you want to do with it. You do not have to live up to any “other or higher order.” Your life here is everything you have and you are free to pursue your own happiness.Realizing that your life is YOUR life is the most important step in your life plan. In fact, if you get only one thing from LFC, let it be the message that your life is YOURS. That is why I have included the message here, right in the beginning. |

|

|

|

How You Arrived Here

It’s fascinating to see how children look at the world. They look at things objectively, without judgment or presumptions. They simply look at what is in front of them and gradually build their understanding of the world from what they see with little concept of self. You were once that little child.

As we mature and become independent, we are gradually able to change this dialogue from “What should I do with my life” to “What do I want to do with my life.” But the inherent conflict in the way we ask the two questions to ourselves can linger on throughout our life.

Why the Answer Matters

For many people, the “What should I do with my life” question is accompanied with an internal dialogue along these lines: “It all went so fast; I had all these ideas about myself and what I wanted to do with my life. Then woooooosssshhhh…time flew by. Here I am now at age X. It all went so fast. What happened?”

We are HERE going to work on your future. We will change the question “What should I do with my life?” to “What do I want to do with my life?” Then we’ll develop some concrete answers you can relate to. We will address topics like the important difference between your professional career choice and your life plan. |

| |

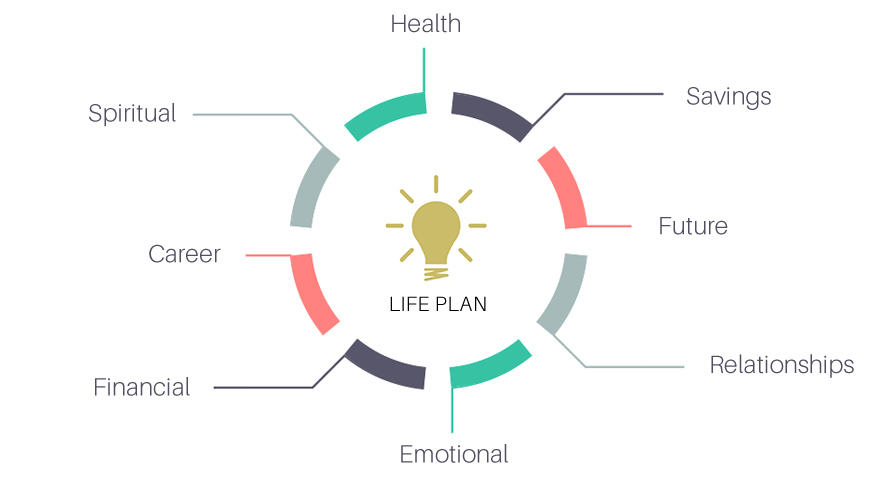

| The main aspects of your life that we will cover in the life plan are :- |

| |

|

| |

“If you don't design your own life plan, chances are you'll fall into someone else's plan.

And guess what they have planned for you? Not much.”Jim Rohn

“Four steps to achievement: Plan purposefully. Prepare prayerfully. Proceed positively. Pursue persistently.” William A. Ward

“Planning is bringing the future into the present so that you can do something about it now” Alan Lakei |

| |

| |

Moving from Financial Planning to Financial Life Planning

Financial life planning is an integrated and humanistic approach to address personal financial issues. Financial life planners help individuals focus on their values and motivations, determine the goals and objectives they have, and then use these values, motivations, goals and objectives to guide the planning process and provide a framework for making decisions that have financial and non-financial implications. The objective is to help individuals to make decisions that support their ability to maintain a quality of life at every stage of life. At the core of financial life planning is the process of “discovery,” with an emphasis on asking meaningful questions. A thoughtful open question will generate deeper thinking on the part of the client, unleash new insight or inspire clarity and direction. It is this type of interaction and planning that is particularly valuable as an individual plans for retirement, as well as considers whether to retire. |

| |

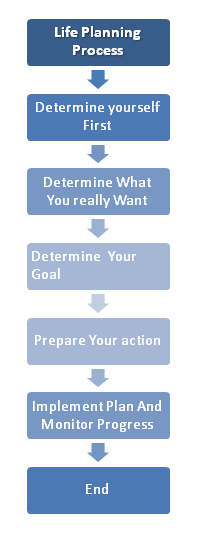

The Life Planning Process

- Be spending more time developing your income

- Have an appropriately funds

- Have estate and retirement plans that incorporate both your family and your goals

- Have reduced your debt and be in good shape financially

- Have more free time to enjoy life.

|

| |

|

| |

|

|

|

|

|

| |

| |

| |

| |